401(k) Plan Advisor for Business Owners

We help you do three things:

Simplify. Amplify. Quantify.

Simplify your plan.

Your 401(k) should be the simplest employee benefit you offer. Features from entrance and eligibility requirements to matching formulas and vesting schedules may add unneeded complexity and cost your 401(k) — and can confuse employees. At EVOadvisers, we can help you find the simplest, most cost-effective way to achieve your retirement plan objectives, giving you more time to run your business.

You’re an expert in what you do.

You don’t need to be an expert on 401(k) as well.

We make 401(k)s clear and simple. Quickly get answers to all of your 401(k) administration questions with our dedicated, experienced team. Receive proactive support and at-a-glance reference tools to meet plan deadlines and ERISA reporting requirements. Increase employee satisfaction with custom videos and resources explaining your plan’s features. Your plan participants can obtain advice from a CFP® professional about their 401(k) based on their unique circumstances at no additional cost.

Amplify your experience.

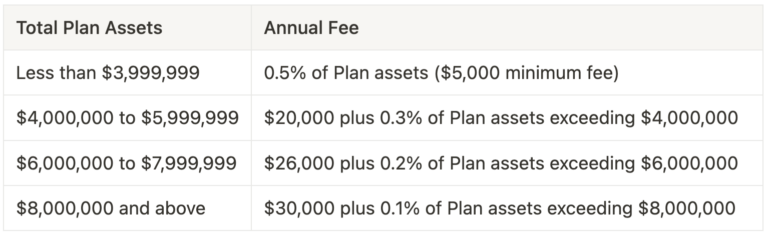

Quantify your costs.

Our goal is to help you understand and control what you’re paying and who is paying it. The true cost of your 401(k) can be a black box. Your business and employees bear the weight of those layers of opaque costs. With no hidden fees, we empower you to take ownership of your cost structure, optimize tax benefits, and minimize the cost to plan participants.

Lower costs today can lead to a more secure retirement.

Our Transparent Fee Schedule

Interested in learning more?

401(k) Cost Structure

401(k) plans are supported by different areas of expertise: record keeping, third party administration, custody, and advice. EVOadvisers acts as your plan’s adviser and main point of contact. We offer to coordinate the activities of services, and our clients like knowing that their plan is supported by an experienced team who knows them and that they never have to wait on hold for a call center rep who doesn’t.

Record keeping, third-party administration, and custody

A record keeper provides the website “face” of the plan to you and your employees, keep record of every contribution from payroll to each employee’s account, and provide your employees with a simple way to track and manage their savings. The third party administrator ensures the plan has the necessary documentation in place and meets regulatory requirements. The custodian is primarily charged with the safe keeping of the assets in the plan and that requested transactions are completed promptly and accurately.

EVOadvisers acts as your ERISA Section 3(38) and 3(21) advisor. This means the services we offer include choosing and monitoring investment options in the plan, offering model portfolios, and consulting on optimal 401(k) plan design. Our Participant Advice service provides employees with the opportunity to meet with a CFP® professional for advice on saving with your 401(k) plan.

401(k) plan advisor

Investment options

Mutual funds have expense ratios, a cost for managing and operating the fund. High fund expense ratios can cause a drag on retirement savings over the lifetime of investing. Making sure your expense ratios are low is important so you don’t pay more for investments with similar returns and outcomes. The average expense ratio of our investment lineup at EVOadvisers is 0.08% as of August 2023.

Too many Americans are being charged way too much via hidden fees in their retirement plans. We've been helping businesses lower these costs for employees while offering a compelling retirement benefit for over 15 years.

– Dave O’Brien, MBA, CFP®, Principal, EVOadvisers

What is a 401(k) Plan Advisor?

A 401(k) plan advisor works as a fiduciary for your plan’s investments and consults on plan design. EVOadvisers acts as both an ERISA section 3(38) and 3(21) 401(k) plan advisor, meaning we not only act as your fiduciary but also provide investment selection with your investment committee. This constant investment monitoring and selection means you have a 401(k) plan advisor with over 15 years of experience assisting you in plan design, investment selection and investment advice. Working with a 401(k) plan advisor can put your firm ahead of the competition by having a competitive employee benefit.