Working with EVOadvisers

Let’s get to know each other

Confidently Managing Your Finances

Thinking about money isn’t always fun. Your life is busy, and handling your financial situation can seem daunting. Do you even have time for this? You could go at it alone if you really want to, but why try to handle it yourself when an experienced advisor can do it with confidence?

Streamlined Process, No Industry Jargon

EVO has created a streamlined process so you can jump straight to living your best life while we keep an ever-watchful eye on your financial wellness. We offer smart, straight talk with less industry jargon so that you won’t be in the dark. See our Jargon Explainer. With our powerful and easy-to-use tools, including our mobile app, you’ll always be in the know with client articles and video updates.

Step 1: Develop your personalized plan together

Let’s Get to Know You

Every client relationship begins by developing your financial plan. We start by meeting “face-to-face” to really get to know you and develop a clear understanding of your current desires and long-term goals. We follow up with our findings—your life goals, dreams, challenges, risk profile, asset allocation, recommended investments, and more—in an in-depth financial report preparing you for the road ahead. Your financial plan becomes the framework for decisions that follow.

In developing your baseline plan, some of the things we will look at include:

- The Road Ahead: What does the future hold between changing jobs, growing a family, paying for college, traveling, and retirement?

- Developing Your Net Worth Report: A rundown of what you have and what you owe, all on one simple page

- A Review of Your Savings: Are you saving enough and in the right places for retirement, college, a health savings account, and a cash account?

- Your Insurance: From home, auto, and personal liability to disability income insurance, life insurance, and more, you want to know that you have the proper coverage at a good price.

- Important Legal Documents: This includes your will, trust, powers of attorney and HIPAA directives, advance medical directives, and verifying beneficiary designations on your retirement accounts and life insurance.

- Your Investments: We’ll peel back the layers of complexity of how your investments work so that you can make informed decisions. Most of our new clients are surprised to learn how much their investments cost them compared to our low-cost approach.

- Taxes: We aren’t CPAs, but we do review your tax position and work with your CPA to determine strategies that may help put you in the most optimal tax position.

- Cash Flow: We’ll look at your cash flow to ensure you’re keeping more of what you earn and don’t pay too much for insurance, investments, and taxes.

- Retirement Income: Regardless of how far away retirement is, we can help you determine the best Social Security strategy for you.

- Unique Things About You: Whether it’s real estate, a career change, family dynamics, a privately held business that we need to research, or your executive compensation structure, we take pride in tailoring our approach to you, the individual.

Step 2: Ongoing Financial Planning and Investment Management

A Living Document

Your financial plan is a living document that should be reviewed and updated regularly. Following the initial development of your plan, we provide ongoing management of your investments by a personal adviser who understands you, your family, and your unique goals.

Based on Nobel Prize-winning research*, we offer a fully personalized approach to financial planning and investment aligned with your risk profile and goals. Rather than acting on emotion, our commitment is to help you maintain discipline through market cycles.

How Our Fees Work

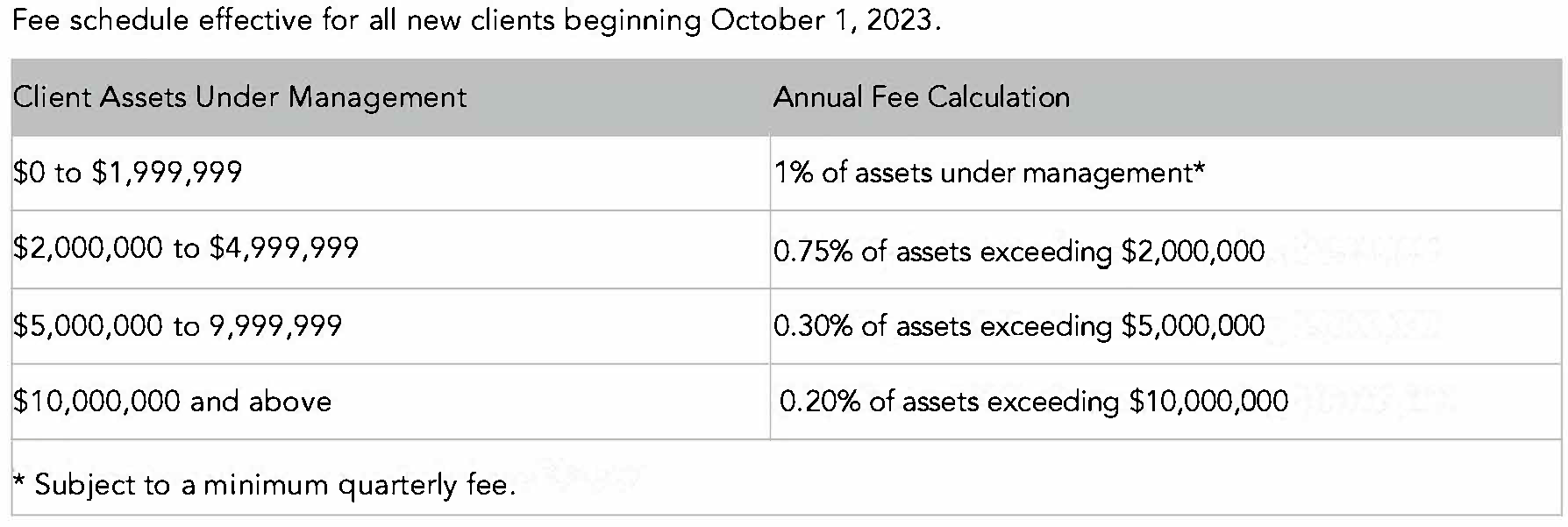

We push the boundaries on the Fee-Only standard by offering our services on a flat fee basis. A flat annual fee for all of our services means you know exactly what you will pay us each year. It also means we make decisions based on your needs, not because of kickbacks “the other guys” collect when taking commissions or winning sales awards for trips to exotic destinations.

Our fee is determined by our Flat Fee Schedule but may be adjusted for clients that have more complex planning needs.

Our Fees

Learn More About EVOadvisers

The 6 Elements of You-Only Advice

The most important part of You-Only Advice® is that you are at the center of everything we do. You’d think this is a normal practice amongst financial advisors, but unfortunately, it’s not. So what does “You-Only” really mean?

1. No sales commissions, just personalized advice

Our advice is aligned with your best interests, so we do not sell unnecessary financial products just to earn sales commissions. Your trust in us is far more important than a few extra dollars in our pocket.

2. Plans customized to your needs and goals

We are independent, meaning we have no corporate edict, cookie-cutter plan, or products to sell you. So we are free to build custom plans that are appropriate for your needs only.

3. Certified Professionals only

Only a third of the 300,000 “financial advisors” in the US are CFP® Professionals (CFP), which is the standard of excellence in our profession. Our financial planners either hold or are working towards this certification, which means our team is held to the highest ethical and fiduciary standards. Learn more about the CFP certification process here. Read our disclosure.

4. Clear and Simple Fee Structure

There are no hidden fees or cryptic fine-print legal disclaimers. We charge a flat fee for our ongoing financial planning and investment management services. We aim to keep our fees as low as possible so you can keep more of what you make.

5. Less Jargon, more clarity

Wall Street and the insurance industry do a poor job of explaining really important things to people. However, we work hard to clarify terms and talk to our clients with as little jargon as possible.

6. Easier to Get Started and Stay on Track

Getting started on your financial journey can be intimidating. We’ve designed a streamlined system to make it easy with regular check-ins to help you stay on track. In our first year working together, we will have several face-to-face (or screen-to-screen) meetings as we develop your personalized financial plan and implement our recommendations.

After our first year together, our clients have found that meeting once a year for a thorough review helps them know they are on track. And while we work behind the scenes for you throughout the year, you can contact us whenever you have a big life event or need help or information. We’re never too busy to answer your questions!

What is Capitalism With a Conscience?

Over the past two decades, we have seen the capital markets in action as more than two billion people have been lifted out of poverty as countries have embraced markets. However, unchecked capitalism can damage people, societies, and even the environment, so our team at EVOadvisers works at the highest levels in Washington, D.C., with regulators and professional organizations like NAPFA to help make the system better for us all.

Placing Your Interests First

By voluntarily working on a “Fee-Only” basis, we choose to “walk the walk” by not placing our interests ahead of yours and by not recommending products that would earn our firm commissions at your expense. This is how we earn and keep your trust.

Financial Freedom is Possible

We believe financial freedom should be accessible to everyone, So we make resources publicly available through our podcasts and blog posts, which provide insights into pertinent financial planning topics. Most of all, we embrace the idea that money is a means to an end and that our families, communities, and planet matter most.

Trust our You-Only, Fee-Only approach.

There are many types of advisors, and it can get intimidating, but we believe how we do business is in the best interest of our clients, no exceptions.