Welcome to EVOadvisers

We plan so you can ... Relax Live your best life Move forward Secure your future

Fee-Only Financial Advisors

EVO is a rare “fee-only” firm, based in Richmond Virginia and serving the nation, meaning we only work for you and your needs — not sales commissions, like 97% of other advisors do. As fiduciaries to our clients, we avoid conflicts of interest and make the best recommendations to get you closer to reaching your goals. We take great care in managing your portfolio and creating your financial plan.

- You-Only Financial Planning ®: We build custom plans that are appropriate for your needs only.

- Fee-Only Fiduciaries: Our fee-only service model aligns our interests with yours and reinforces that we put your interests first.

- The EVO Experience: Life evolves, and your financial plan should, too. That's why we're always available to help with the big and small life events.

Disclosure

EVOadvisers is an Investment Advisory firm. The statistics cited are applicable to individual investment advisors. Any comparison is not with other advisory firms similar in size and type services. Sources may have used different criteria for defining “adviser”, “financial adviser”, or any other similar term. Source Data, 2021:

- Number of financial advisers in U.S.: 263,000. Source: U.S. Bureau of Labor Statistics

- Number of CFP Professionals: 80,000. Source: CFP Board of Standards

- Percentage of advisers charging commission: approximately 10,000. The National Association of Personal Financial Advisors estimate.

Co-founders John Clair, CFP® and David O’Brien, MBA, CFP®, and principal Stephen Fletcher, MBA, CFP®.

Putting Together Your Complete Financial Picture

Investment

Management

Develop a plan to help you achieve your personal financial and investment goals

Risk

Management

Forecast and evaluate financial risks and identify ways to avoid or minimize their impact

Estate

Planning

Designate who will receive your assets in the event of your death or incapacity

Tax

Planning

Maximize tax breaks and minimize tax liabilities by analyzing your specific financial situation

Retirement

Planning

The transition from working and saving to living off of your savings is often stressful.

Cash

Flow

Understand and optimize the amount of money moving in and out of your accounts

Simplify, Amplify, and Quantify Your 401(k) Experience

Simplify

Your Experience

At EVOadvisers, we can help you find the simplest, most cost-effective way to achieve your retirement plan objectives, giving you more time to run your business.

Amplify

Your Experience

Receive proactive support and at-a-glance reference tools to meet plan deadlines and ERISA reporting requirements. Your plan participants can obtain advice from a CFP® professional about their 401(k) based on their unique circumstances at no additional cost.

Quantify

Your Experience

Our goal is to help you understand and control what you’re paying and who is paying it.

Put us to work for you

Confidently Manage Your Finances

Your life is busy, and handling your financial situation can seem daunting. You could go at it alone if you really want to, but why try to handle it yourself when an experienced advisor can do it with confidence?

Streamlined Process, No Industry Jargon

Our streamlined process allows you to jump straight to living your best life while we keep an ever-watchful eye on your financial wellness. We offer smart, straight talk, with less industry jargon so you won’t be in the dark.

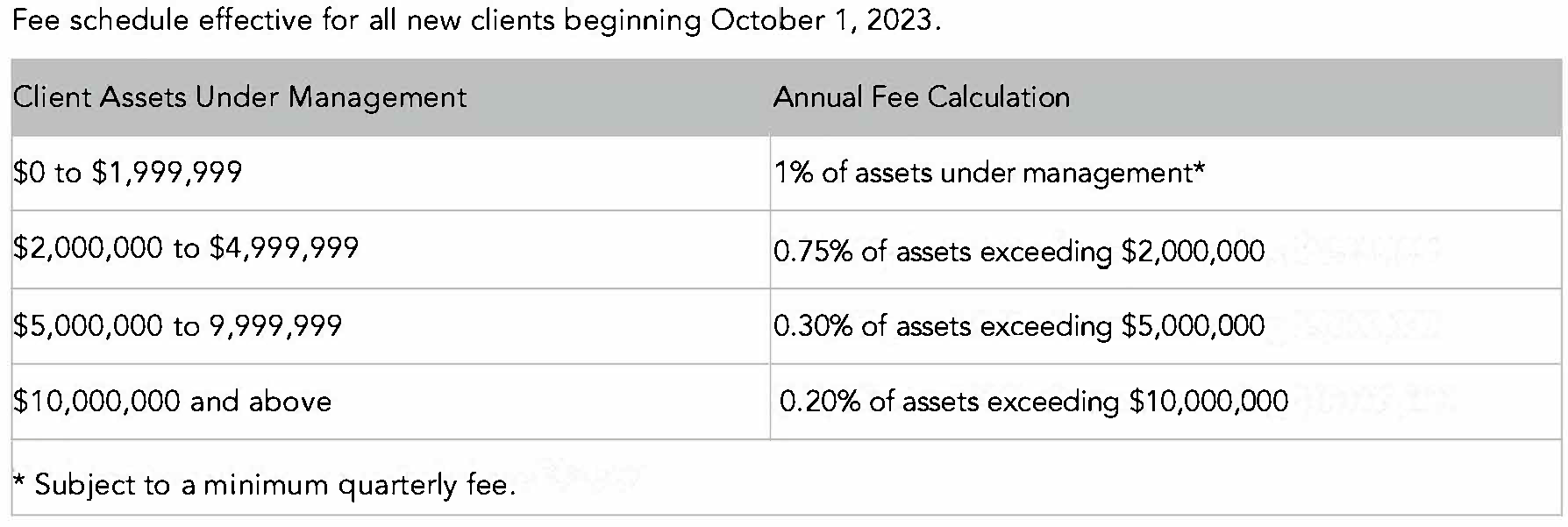

How Our Fees Work

- We operate on a unique flat fee basis, which means you know exactly what you will pay each year.

- An annual flat fee means we make recommendations in your best interest, not because of hidden compensation for us.

- Our flat fee schedule determines our fee but may be adjusted for clients with more complex planning needs.

You are more than the size of your portfolio. At EVO, we have no minimum portfolio size.

Our Fees

News, Podcasts, & Insights

Tax Deductions, and Who Gets Them

How does the 2025 Tax Bill Impact You?

4 Estate Planning Pitfalls

Future-proof your finances. Let's Connect.