FAQs

Frequently Asked Questions

Every client relationship begins by developing your financial plan. We start by meeting “face-to-face” to really get to know you and develop a clear understanding of your current desires and long-term goals. We follow up with our findings–your life goals, dreams, challenges, risk profile, asset allocation, recommended investments and so much more–in an in-depth financial report preparing you for the road ahead. Your financial plan becomes the framework for decisions that follow.

We know a principle isn’t truly a principle until it costs us something. By voluntarily working on a “Fee-Only” basis, we choose to “walk the walk” by not placing our interests ahead of a client’s and not recommending products that would earn our firm commissions at a client’s expense. This is how we earn and keep our clients’ trust. We also strive to offer the kind jargon-free clarity and transparency that we wish to see in the rest of the financial world.

Most of all, we embrace the idea that money is a means to an end and not an end itself. It is our families, communities and planet that matter more. So we strive to help our clients do well so they may do more good for others.

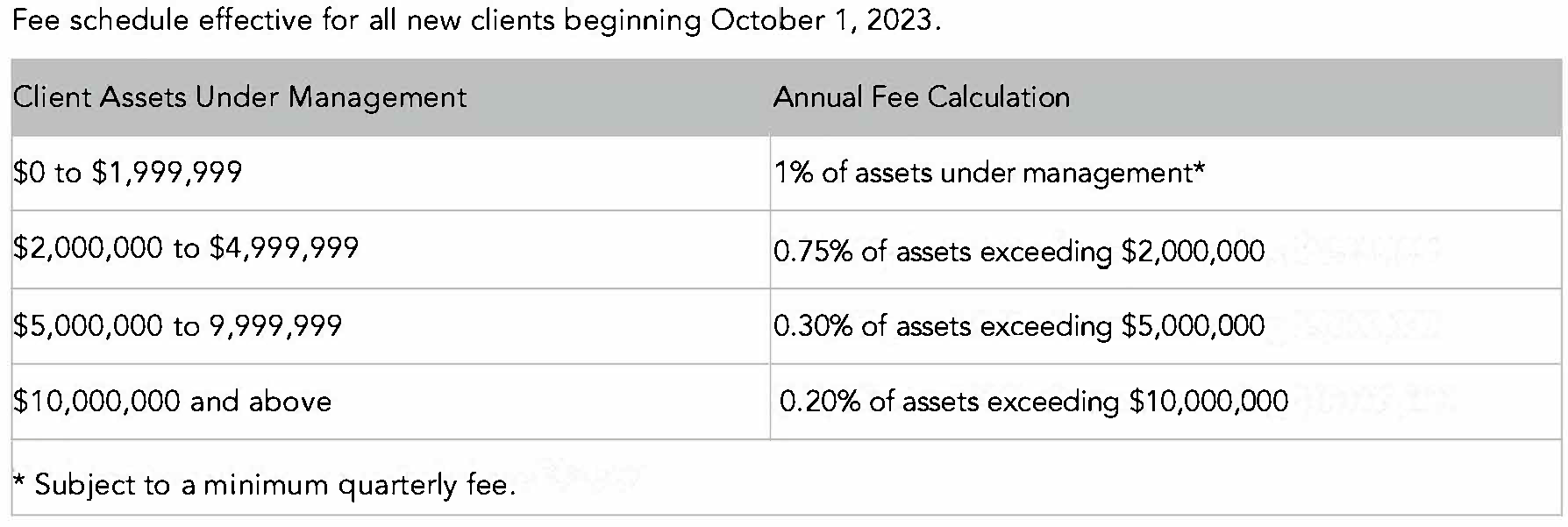

Our fee is determined by our Flat Fee Schedule, but may be adjusted for clients that have more complex planning needs. Our minimum annual fee is $10,000.

CERTIFIED FINANCIAL PLANNER™ certification is the standard of excellence in financial planning. CFP® professionals meet rigorous education, training and ethical standards, and are committed to serving their clients’ best interests today to prepare them for a more secure tomorrow.

A fee-only advisor is compensated only by the fees he or she directly charges to clients and not by commissions earned from a sale of a financial product.

Advisors who follow a fiduciary standard are required to put their clients’ interests first—before their own financial interests or their firm’s sales goals. That means the advice they give you will be based solely on what’s best for you, whether or not it benefits them or their employer.