Let’s talk current events and your investment portfolio. We’re in an age of information. Never in history has such a large volume of information traveled so far so quickly. It can be daunting at times to know what to listen to and what to ignore. As financial advisers, we’d like to shed some light on this, and with hope, bring some peace of mind.

We’ve all seen the news in recent weeks regarding the war in Israel and possible implications this could have on inflation and your investment portfolio. You’ve probably asked yourself some questions and have likely seen ads on TV, online or through the mail on what you should be doing with your investments now.

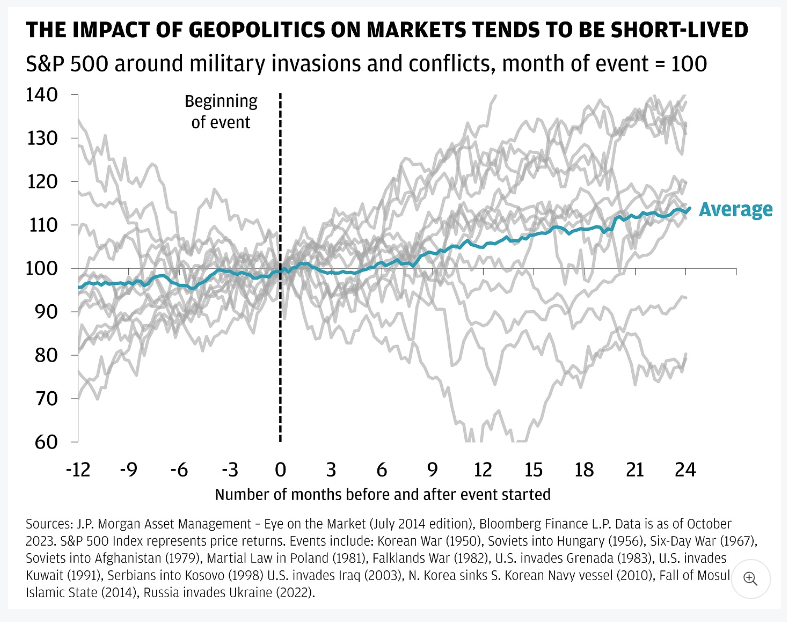

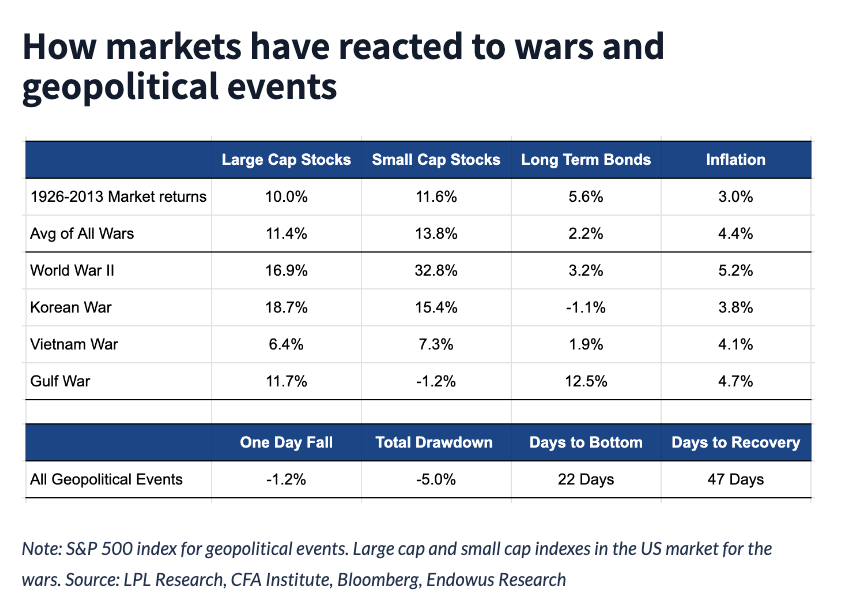

First, let’s start with the Ukraine and Israel Hamas Wars. We are frequently asked whether investors should be doing something different with their investment portfolios because of multiple conflicts around the world. Contrary to some beliefs, since 1926 markets have performed better during wartime. Inflation slightly increased during these periods, but higher market performance more than made up for that. Market shocks from wars and other geopolitical events are often short-lived and the fear and uncertainty surrounding them usually does more damage to investors than the impacts of the events themselves. This is why we recommend staying the course during uncertainty.

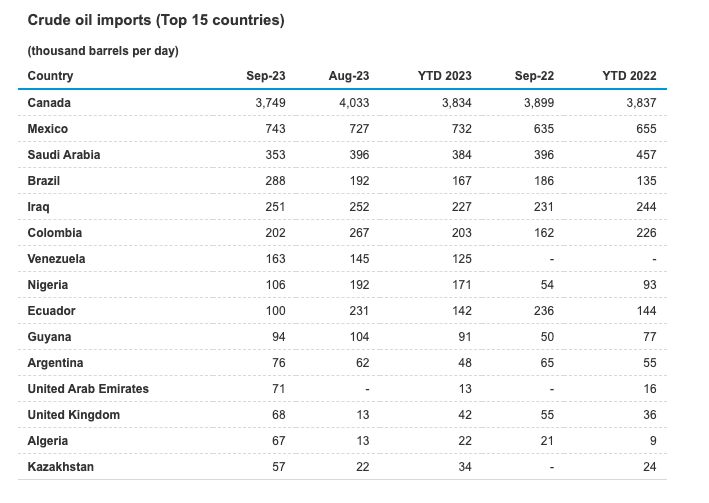

Secondly, with the Israel Hamas War, should we be concerned with its potential impact on oil supply and costs here in the US? At the moment, most reputable financial publications aren’t overly concerned. The current supply and demand of oil is more in balance now than during Russia’s 2022 invasion of Ukraine when the supply of oil was already low relative to demand. Additionally, the current conflict does not involve major oil exporters. If tensions escalate and sanctions on Iran increase, this could cause some disruptions, but Iran only makes up 4% of global oil supply while 20% of the global oil supply throw flows through the Strait of Hormuz, most of that now goes further east to Asia. And you may be surprised to hear that the US has continued to increase oil production as of August 2022. The US produces around 75% of domestic oil Demand. On top of that, the US also receives most of its oil imports from Canada and Mexico with Saudi Arabia coming in third place at one 10th the amount Canada provides to the US. So even if the Strait of Hormuz closes, most of the US’ oil supply would not be affected.

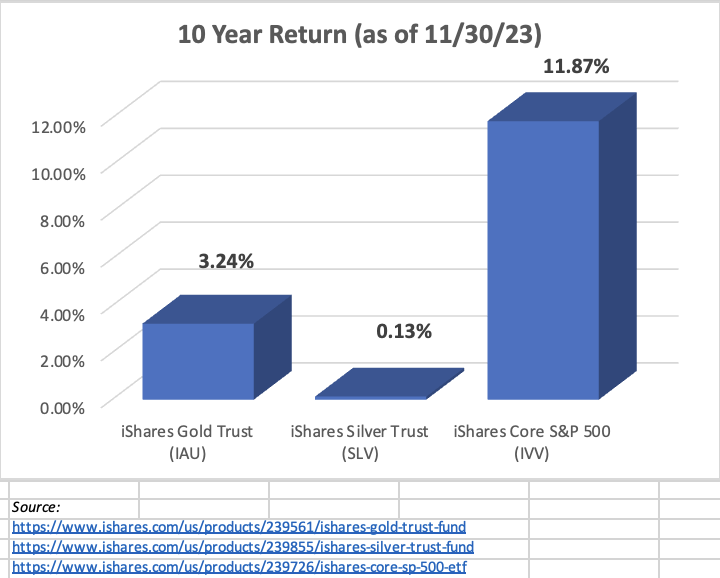

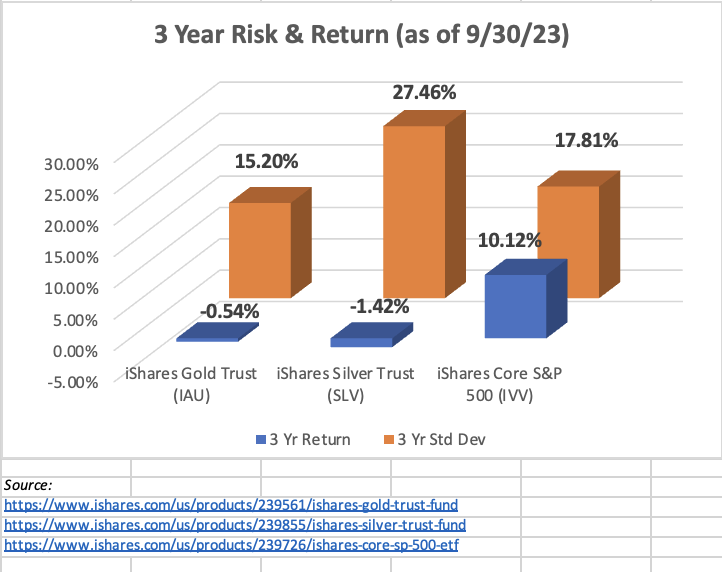

Finally, whenever the headlines are bad, articles abound covering the virtues of precious metals like gold and silver in a portfolio. Gold always seems to be mentioned as a hedge against inflation. While this may be true over certain short-term time periods, allocations to stocks continue to be the best long-term solution to inflation. Most 10-year returns on stocks outpace inflation significantly compared to gold’s appreciation. The iShares gold fund IAU has returned a 10-year average performance of 3.24% while the 10-year average performance of the S&P 500 Index Fund IVV was more than three times that at 11.87% (note: data provided from this section comes from the iShares prospectus and is as of end of Q3 2023). All of this is in addition to risks in gold investing. The three-year standard deviation, a measure of risk of gold using the iShares IAU is 15.2% and the S&P 500 using the iShares IVV as a proxy has a standard deviation of 17.81%.

What does this mean? The volatility taken on gold is similar to that of the S&P 500 over the past 3 years, but the returns were much worse. IAU’s three-year return is -0.54% while IVV’s is 10.12%. The historical performance of gold doesn’t seem to support the claims of some of the gold bugs out there. You will find that similar relationship exists for silver as well.

So in conclusion, we suggest that gold and other precious metals are not the best long-term positions in portfolio due to the higher volatility than bonds and lower returns than stocks. We hope you found this discussion helpful. Please feel free to reach out to us if you have any questions.

Jack O’Brien CIMA® is a Certified Investment Management Analyst educated at Chicago Booth School of Busisness and Virginia Tech. EVOadvisers is a fee-only financial advisor based in the Scott’s Addition area of Richmond, Virginia. EVOadvisers also has an office in Irvington, Virginia to better serve clients in the Northern Neck of Virginia. If you have any questions about financial planning and would like to talk with one of our Certified Financial Planner professionals, check us out at www.evoadvisers.com or call (804)794-1981.