Anyone following financial news in the first eight months of 2022 hasn’t had much to be happy about.

Following two years of pandemic shocks to the economy and efforts to counter its effects by governments and businesses, Russia’s war in Ukraine ended hopes for a quick return to calmer times. Inflation and gas prices spiked, stocks and bonds took a plunge. The rapid rise in prices has hurt but stopped rising mid-Summer. Unemployment levels are low. Policymakers are taking steps to prevent runaway inflation. If you took Economics in college, you may feel like you’re living through textbook examples.

These economic factors can generate anxiety. We all hear a lot of financial terms to refer to the current – and any – economic conditions. Consider terms like “recession” or “bear market. These can feed into people’s worries. Some perhaps justified…some perhaps unnecessarily.

It can help to clarify what some of this terminology actually means and lend it some context regarding the long-term significance of temporary downturns to your portfolio.

Normal?

First off, market downturns, like the one we are experiencing in 2022, are not rare events.

Since 1980, there have been

9 bear markets – with declines of 20% or more for at least two months

and

6 recessions – which mean that the broad economic conditions declined for more than two successive quarters.

Note that a recession and a bear market are not the same, though they can be linked. Whether we are actually in one or both of these at any given time, isn’t necessarily the point. They are both ways to officially define market and economic conditions. I wouldn’t get too hung up on whether where we are today fits the definition or not.

Ride it Out

Warren Buffet has said that “the most important quality for an investor is temperament, not intellect”. Riding out periods of uncertainty and remaining disciplined is a good approach for years like 2022.

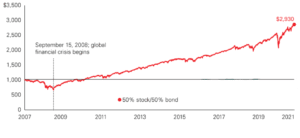

Take a look at this chart of how a hypothetical portfolio made up of 50% stocks and 50% bonds fared since 2007 — through the very deep, but very short market drop in 2020 and the 2008 global financial crisis – the country’s most significant financial shock since the Great Depression.

Starting with $1,000, a patient investor who stayed the course would have nearly tripled their money 14 years later.

Riding out a rough period in cash, bonds, and a mixed portfolio

Sources: Vanguard calculations, using data from FactSet. All data as of December 31, 2021.

Sources: Vanguard calculations, using data from FactSet. All data as of December 31, 2021.

Notes: This is a hypothetical illustration, does not represent any client of EVOadvisers and is not investment advice. The portfolio is represented by 50% S&P 500 Index and 50% Bloomberg U.S. Aggregate Bond Index; bonds are represented by Bloomberg U.S. Aggregate Bond Index; and cash is represented by 3-month Treasury bills. Past performance is no guarantee of future results. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index. Investments in bonds are subject to credit, interest rate, and inflation risk. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

We’ve all grown accustomed to bull markets, so it can be easy to forget that the price we pay for what have historically been solid returns is seeing stock and bond prices go down. History shows that’s practically guaranteed. And sticking to your plan – and maybe not paying too much attention to the constant news feed — is the best way to achieve your goals.

As CFP® Professionals, we at EVOadvisers include these regular events in our clients’ financial plans. We don’t know when they’ll occur, or what they will look like, but our clients can be confident that their financial plans can work through many random paths on the road ahead.

John B. Clair is a Certified Financial Planner™ professional (CFP®) and NAPFA-registered financial advisor. EVOadvisers is a fee-only financial advisor based in the Scott’s Addition area of Richmond, Virginia. EVOadvisers also has an office in Irvington, Virginia to better serve clients in the Northern Neck of Virginia. If you have any questions about financial planning and would like to talk with one of our Certified Financial Planner professionals, check us out at www.evoadvisers.com or call (804)794-1981.