Elections come with a reliable frequency. Market movements, though, are fairly unpredictable. While historical market data reflects this, human psychology can fall prey all too often to the most dangerous phrase in investing –“but this time it’s different.”

Most investors want reasonable returns — to be compensated for the risk they take on. When looking at the annualized returns of different portfolio allocations, we may feel that a specific return attracts us, BUT we may forget the risk that we will need to endure over time to receive these returns. Risk, of course, includes the natural, unpredictable ups and downs of a portfolio’s value.

Perception is different from reality. At EVOadvisers , when we work with a new client, we ask them to take a risk tolerance questionnaire to gauge their appetite for financial risk. This is just one of the approaches we use to determine the right allocation for a client’s portfolio. The final question of our questionnaire asks “What do you think your score will be?” This is one of the most important questions on the survey, because it gets at each person’s perception instead of their answers to objective and rational questions. While these questionnaires are helpful to determine “risk tolerance”, they do not necessarily show how one will feel and act when actually experiencing the effects of the risk. Endurance through good and bad times is vital to long term investment success – what investment professionals call “staying the course.” Difficultly staying the course when turbulence arises is a clear sign that your portfolio risk level may be too high for you.

Which brings us to election cycles. If every four years you have the urge to adjust your portfolio allocation in anticipation of the election’s outcome, your current allocation may not be optimal.

For example, what if a portfolio with 60% stocks and 40% bonds is a good fit for your personal financial plan and offers enough of a ballast (bonds) to sleep well at night rather than worrying about your investments. But what if once every four years this bliss breaks down, and fear of, or excitement about the election’s possible outcome causes a strong urge to change your allocation? We would argue that 60/40 portfolio may not be a good fit for you to stay the course over time. Going to cash once every four years or selling out of stock positions can have impacts on both your financial plan as well as on your tax bill.

Going to Cash During an Election

Let’s take an investor who, for the past four years, has been invested in a portfolio holding 80% in stocks, and 20% in bonds. What if that investor sold their stocks just before an election and waited for a year before buying them back. That individual had 4 years of an 80/20 portfolio and 1 year of a 0/20/80 portfolio (where 80% was now held in cash). Over the course of those 5 years the average allocation of the portfolio was not an 80/20, but rather a 64/20/16, with only 64% of the portfolio being in equities on average and 16% being in cash when averaging over five years. This may indicate that a portfolio holding only 60% stocks and 40% bonds would be more suitable for the individual than their current target allocation of 80/20. Even though the investor may prefer to have long-term returns that track with a 80/20 portfolio, in reality their portfolio has likely performed worse than a 60/40 since for a period of 1 year they were in cash likely earning less than the 60/40 would earn during the same period. History shows how much damage can be done to a portfolio by missing the best days. https://www.visualcapitalist.com/chart-timing-the-market/

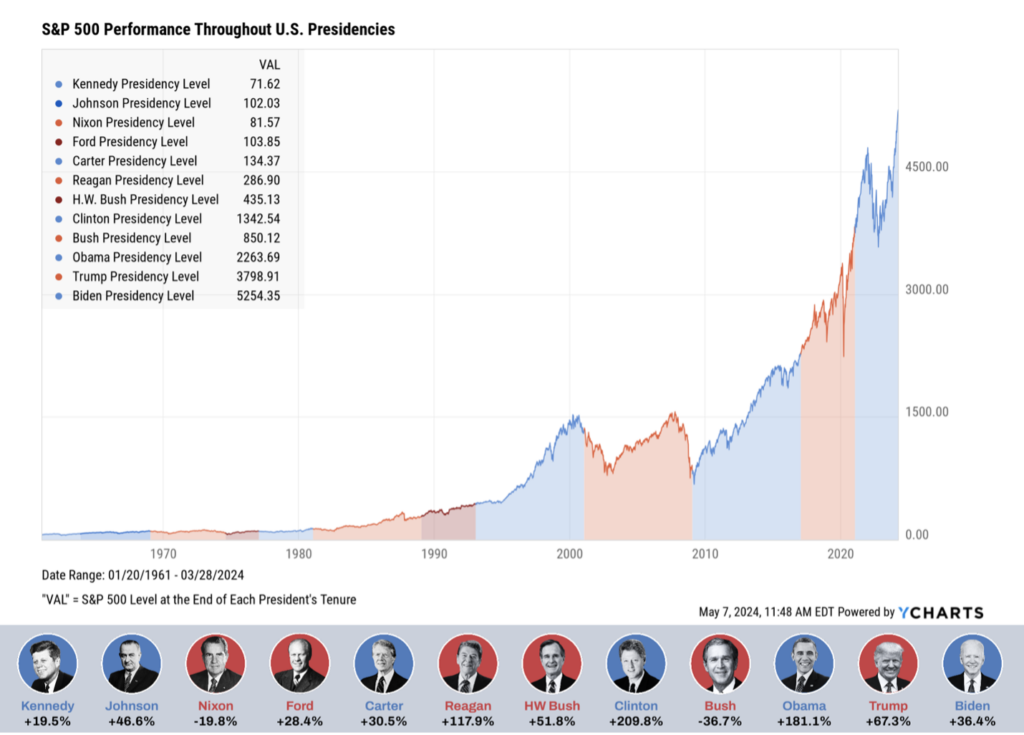

Why would this investor go to cash in the first place? Perhaps they believed that the U.S. presidential election would trigger a major market event that would result in stock prices falling, and by going to cash they would be better off than staying the course. Historically speaking, in most scenarios they would be worse off by going to cash, not better off. Contrary to what many people may believe, the stock market has performed better on average during election years. This is a disconnect between perception and reality. Since the 1928 election, markets have had a positive return during an election year 83% of the time. The average return in those election years was 11.28%, a higher return than the average performance for all years between 1928 to 2023 of 9.9%. Vanguard research dating to 1860 shows there is no statistical relationship between a 60/40 portfolio’s performance and election years — elections have had no significant impact. Fears around elections, and the affects they will have on financial markets have been a psychological impediment to investing success long before the 21st century, but they have not come to fruition when looking at the statistical relationship elections have on markets.

In the case of the investor who went to cash for one year out of five, their actual return and average allocation over five years look starkly different than their target return – the return of an 80/20 portfolio. Not only can going to cash influence portfolio returns, but it will likely have a tax impact too. “Go to cash” stock sales that would take place in a taxable account may incur capital gains tax, assuming the assets are being sold for a gain and not a loss. Liquidating a $500,000 taxable account which triggers $100,000 in capital gains means that 20% of the portfolio is subject to taxes. If these are long term gains, they will be taxed at the capital gains tax rate, but if the assets were held for under a year, they will be taxed as ordinary income. Liquidating this $500,000 portfolio will generally result in the investor keeping less than $500,000, because taxes are owed.

Going to cash also introduces the question of “when do you reinvest?”

Reinvesting once you have gone to cash can be equated to “catching a falling knife” when markets are falling, and “holding out for ‘the big one’” when markets continue to rise despite the decision to liquidate. In an event where the market does decline and an investor goes all to cash, they may be fearful to invest in the market that has been declining, the thought of “how low can it go?” starts to creep in, and hesitation can result in being on the sidelines until the market already has rebounded, leaving the investor worse off than had they done nothing.

In the other scenario, the investor goes to cash and watches the market continue to rise but may believe (or hope) that there is a downturn just around the corner. This can create emotional resistance to reinvest and force them to admit they jumped the gun and went to cash when they should have stayed the course. This event can leave an investor in cash for a long period of time as they wait for the market to decline below its value at the time they went to cash – a day that may never come. Despite the market declines of 2020 and 2022, neither came close to declining back to the values during 2007-2009, meaning an investor waiting around for the market to crash back to great recession valuations would still be waiting for “the big one” that may never come. And who wants to live in such a pessimistic condition, anyway?

Adjusting a portfolio to a less risky allocation during elections will result in lower average returns and a more conservative risk profile than it’s pre-adjustment target allocation. While this may not seem like an issue, the tax cost of liquidating stocks to reduce risk can have a greater impact on long-term returns than staying the course with a portfolio expected to have lower volatility and risk.

All this to say that an emotional resistance to staying the course with your investments may be a “canary in the coal mine” telling you the allocation is not ideal for your emotional wellbeing. And that’s paramount to living a fulfilled life and your financial success.

Markets and Election Volatility

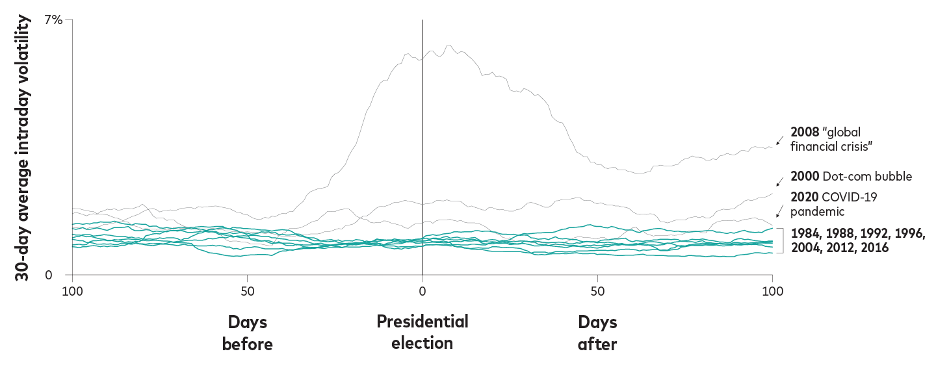

Volatility decreases for several reasons, and an important one is inaction driven by the unknown. Investors may be waiting to see who is elected before making significant financial decisions. This decreased trading activity can aid in lowering volatility during the 100 days before and after presidential elections. Volatility is seen during times of financial crisis, such as during the 2008 global financial crisis, the dot-com bubble of 2000, and the COVID-19 pandemic. All these three crisis events saw much higher volatility than during the election years of 2016, 2012, and 2004. While the volatility from global events in 2008 and 2020 were both election years, the elections themselves were not what caused the volatility but the global crises.

While presidential elections are important, they are not significant market events. It is important to stay the course with your long-term financial plan rather than to make decisions in response to political fears. Controlling our emotions is paramount when it comes to successful long-term investing. Election years always bring pundits attempting to use our emotions to galvanize support of a political candidate but letting them sway our investment decisions can be damaging to long term success.

Conclusion

Elections can strike fear in many, and bring about a feeling of uncertainty to our lives and the fate of our nation and world. Fear is not something that commonly engenders good financial decisions, though. Often in financial planning and long-term investment management, our worst enemies can be our emotions. Remembering to put our emotions aside and assess what happens is important in our long-term success.

Going to cash is akin to timing the market, and is unlikely to be successful. Such liquidation events will likely have taxable impacts on the investor. Deciding when to reinvest the cash back into the market at some point in the future may result in the cash being invested at a suboptimal time. This can leave the investor worse off than if they had stayed the course through times of volatility. These changes to a portfolio can be damaging to the investor from a tax standpoint, and may also result in the individual’s portfolio performance deviating significantly from their desired performance. This all can indicate that the stock to bond allocation the investor holds is not ideal for them if, during times of volatility, they begin to panic and sell rather than being able to endure the volatility of their selected portfolio allocation.

It is vital to remember the importance of staying the course when investing, and to understand that our emotions can be at odds with our long-term goals. Despite the beliefs that we may hold, knowing that making emotional decisions about our portfolio is generally a suboptimal strategy. Talking with your financial planner to discuss how you are feeling is always better than making rash decisions that are motivated by fear. While election outcomes are uncertain, how we behave in relation to our long-term financial plan should not be. Staying the course, and finding an allocation you can hold through uncertain times is a key to financial success.

Sources

Chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://advisor.morganstanley.com/the-ernie-garcia-group/documents/field/e/er/ernie-garcia-group/S%26P%20500%20in%20Presidential%20Election%20years.pdf

https://www.morningstar.com/funds/actively-managed-funds-continue-underperform

https://www.schwab.com/learn/story/large-bidask-options-spreads-volatile-markets

https://www.ml.com/articles/tax-smart-investing-strategies.html

https://advisors.vanguard.com/portfolio-construction-tools/model-portfolios/crsp

https://darrowwealthmanagement.com/blog/stock-market-performance-by-president-in-charts/

We recommend investors speak with their financial advisor to ensure their investment portfolio is in alignment with their long-term goals. If you don’t have a financial advisor and would like to meet with a Fee-Only® CFP® professional at EVOadvisers, please follow this link to schedule time.

Jack O’Brien CIMA® is a Certified Investment Management Analyst educated at Chicago Booth School of Business and Virginia Tech. EVOadvisers is a fee-only financial advisor based in the Scott’s Addition area of Richmond, Virginia. EVOadvisers also has an office in Irvington, Virginia to better serve clients in the Northern Neck of Virginia. If you have any questions about financial planning and would like to talk with one of our Certified Financial Planner professionals, check us out at www.evoadvisers.com or call (804)794-1981.