The rise and fall of GameStop (GME) stock has come as quite a surprise. GameStop — a company that has seen a shrinking market and declining stock price over the past five years — recently saw its stock price increase from yearly lows below $5 to highs above $300.

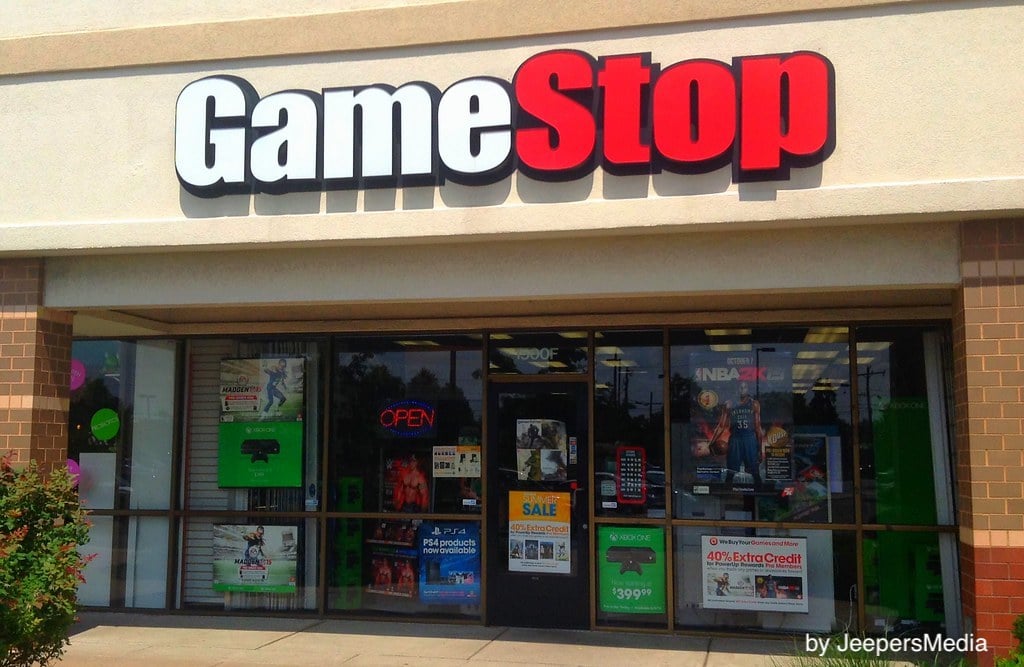

This has not occurred as a result of GameStop’s future prospects as a company. GameStop sells video games and equipment from brick and mortar stores in a gaming market seeing a move to online gaming and sales (remember BlockBuster Video stores?). GameStop stock price has increased so dramatically as the result of social media and individual investors. GameStop (GME) is not alone in this new category of social media stock called “Meme Stocks”. Other companies include AMC and Blackberry. While prices of these stocks in the short term will move based on the demand for them, the bubble may likely burst before long, pushing stock prices back to their normal values and resulting in many investors losing money while only a few walk away richer.

The story of the “Meme Stocks” reiterates how a balanced portfolio is the best way to generate market returns at a risk level that best matches your financial needs. While GameStop will not be the last stock to have a story like this, we at EVOadvisers encourage our clients to consider prudent, long-term investing, instead of speculating.